2030 Is Coming—And the Clean Energy Rollout Is Failing Where It Matters Most

What’s Working, What’s Failing, and What It Takes to Move Forward

Quick take

2030 targets are off-track—execution, not ambition, is the problem

Offshore Wind is stalling across the US, UK, and EU

Permits, grids, and risk allocation are still broken

Under the Paris Agreement, countries committed to reducing emissions by 45% from 2010 levels by 2030 to keep 1.5°C within reach.

Everyone’s got a roadmap. Governments, utilities, tech startups, and NGOs all say we’re “on track” for 2030. But look closer, and the transition is stuck in second gear—held back not by technology, but by structural incoherence.

The IEA, IPCC, and national strategies all align major milestones around 2030 as the “make or break” decade.

Deployment needs to peak before 2030 because, after that, catching up would require either mass-scale carbon removal or adapting to overshoot scenarios [IPCC AR6 Synthesis Report].

2025 Snapshot

Fit for 55 commits the EU to at least a 55 % cut in GHG emissions by 2030, while REPowerEU raises renewable ambition to ~45% of energy use and 600 GW of solar capacity by 2030. Yet many countries still take 3–10 years to permit wind projects, and 8–10 years to connect them to the grid—delays built into the system that choke any front-loaded ambition.

The U.S. has committed to reducing GHG emissions by 50–52% below 2005 levels by 2030, supported by the Inflation Reduction Act and Bipartisan Infrastructure Law. But the bottleneck isn't ambition—it’s permitting. Across states, clean energy projects face 4–6 years of environmental review, while transmission lines can take 6.5 to 10+ years to get built. Around 40% of wind projects are stuck in queues, and interconnection delays are now a top reason for cancellations. Recent reform efforts aim to shorten timelines to two years—but most control still lies with state and local authorities.

In the meantime, China is racing ahead, with plans to reach 1,285 GW of solar and 900 GW of wind by 2030. But rapid deployment doesn’t guarantee integration. Grid constraints have caused curtailment losses of 20–30%, especially in western provinces where generation far outpaces transmission capacity. The Gansu Wind Farm, for example, operated at just 40% capacity for years until HVDC upgrades caught up—four years behind schedule. Even in China’s centrally planned model, grid and permitting misalignments are slowing delivery.

Meanwhile, emissions aren't dropping fast enough, fossil subsidies have crept back in, and too many projects exist only as press releases.

Global emissions are still climbing—CO₂ rose 0.8% in 2024 and hit a new high of 37.4 billion tonnes. Meanwhile, governments spent over $620 billion on fossil fuel subsidies in 2023, vastly outpacing clean energy support. In Germany alone, fossil subsidies reached €41 billion last year. And behind the scenes, many clean energy projects quietly disappear—99% of Australia’s green hydrogen schemes are now dead, and the U.S. alone saw $14 billion in canceled clean investments in 2025 so far.

Despite growing policy ambition, not every clean energy auction translates into a built project. The chart below shows global auction results from 2021 to 2024 for utility-scale solar PV, onshore and offshore wind, and hydropower. It tracks how much capacity was auctioned—and how much was actually awarded. The gap reflects familiar barriers: unworkable economics, permitting delays, and rising delivery risk.

Global renewable energy auction results and award rates, 2021–2024. Source: IEA (2024), Licence: CC BY 4.0.

Offshore Wind: The Canary in the Coal Mine

Offshore wind is not failing because we stopped believing—it’s failing because the system isn’t ready.

Why System-Level Design Matters

Steel, cable, and turbine price inflation pushed strike price caps well below real cost curves, stripping project margins [source: mckinsey.com]

Inflation-linked PPAs were either absent or capped, exposing developers to sharp cost escalation post-contract.

The result: developers carry downside risk, while governments remain optimistic—a misalignment that repeats in failed offshore rounds or canceled bids.

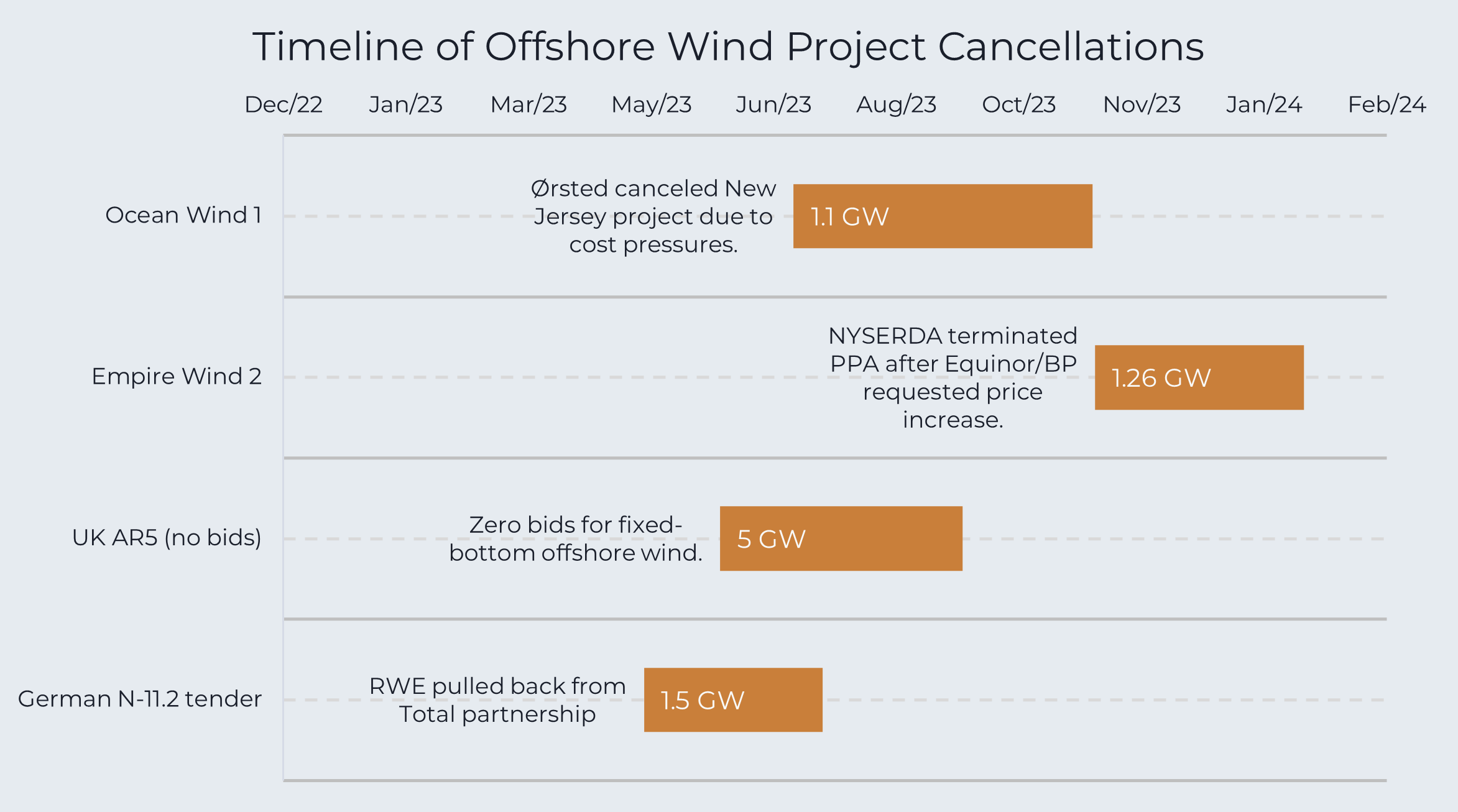

Germany: RWE withdrew from the 1.5 GW N‑11.2 tender in mid‑2023 after stating that the capped strike price (~€73.5/MWh) was incompatible with inflation in steel, cables, and capital costs—even though TotalEnergies stayed on board and later took the project alone.. [source: Reuters]

UK: In Allocation Round 5 (AR5), zero fixed-bottom offshore wind bids were submitted, a first in UK history—driven by strike price caps, inflation, and poor EPC availability. [source: Catapult]

USA: In New York, New Jersey, and Massachusetts, developers renegotiated or canceled contracts for over 4 GW of planned offshore wind. Ørsted and Equinor walked away from prior PPAs, citing inflation, supply chain disruption, and missing inflation protections in bids. [source: Reuters]

While these examples aren’t the whole story—they represent a systemic issue. When flagship tenders and market leaders walk away, it’s not about belief—it’s about structural misalignment.

These failures aren’t signs of collapse—they’re feedback loops. While offshore wind stumbles, other parts of the system are showing where scale is still possible.

Selected offshore wind project cancellations between 2022 and 2024. These weren’t sudden failures—they unfolded over months as cost pressures, policy gaps, and contract misalignments made delivery unworkable.

What’s Still Working

This isn’t a collapse—it’s a course correction. A few parts of the system are still moving in the right direction:

Solar and storage are hitting grid parity in more regions, with auction prices consistently beating fossil alternatives in places like India, Chile, and parts of the U.S.

Electrolyzer prices have fallen by more than 40% since 2020, and further cost declines are expected—but actual deployment still lags behind national hydrogen targets.

Corporate buyers are anchoring demand through long-term PPAs—particularly in data centers, heavy industry, and tech. They want real electrons, not ESG fluff.

Capital is still available—but it’s choosy. It flows where permitting is fast, contracts are inflation-indexed, and grid access is real. The message: vision is not enough.

So what’s holding the rest of the system back? It’s not the tech. It’s the system design.

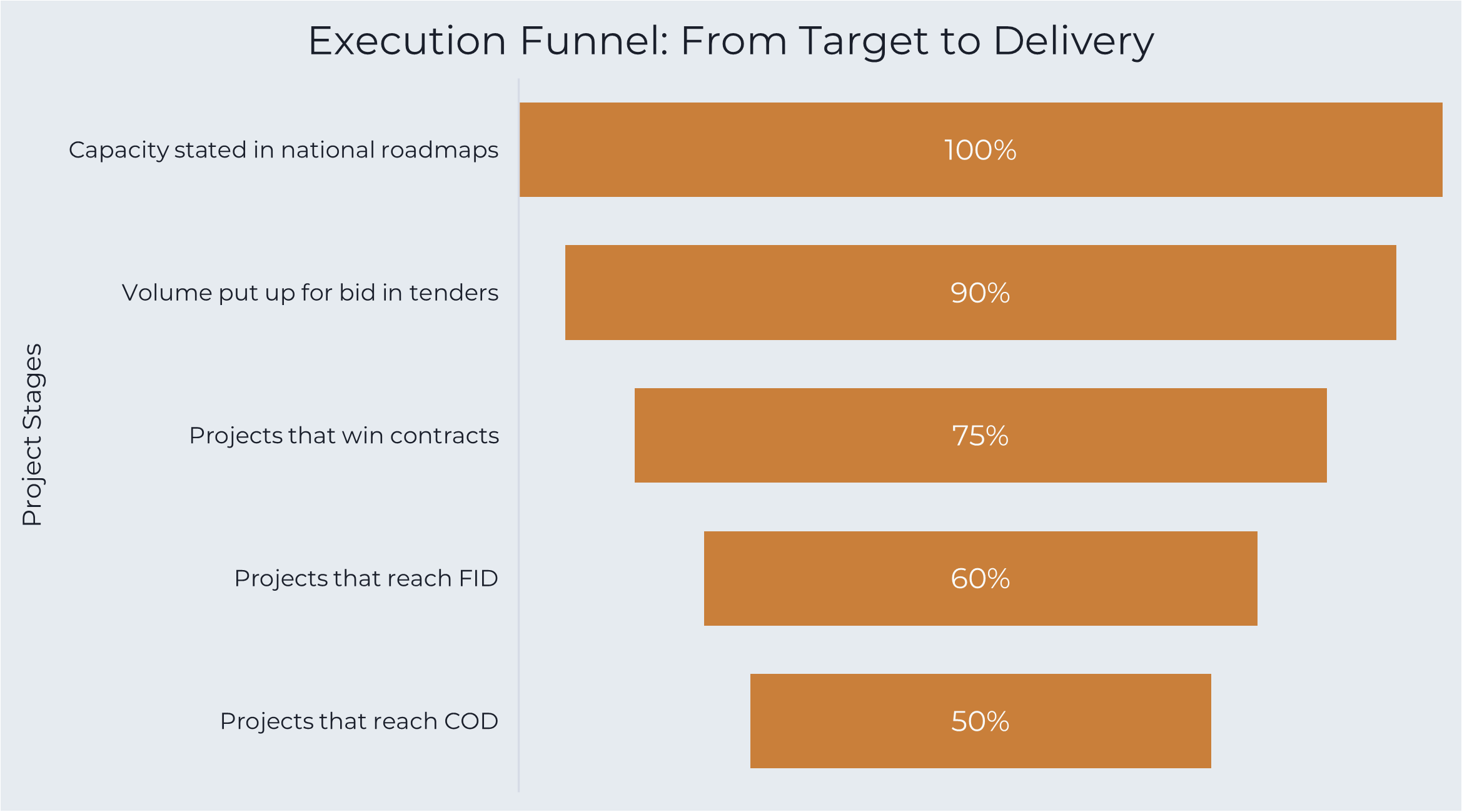

The execution funnel tells the story—how roadmaps fall apart between auction and operation.

Why the Transition Stalls

This isn’t about whether the technology works. It’s about whether the system around it is executable.

Permitting gridlock: In Germany, permitting a new wind or solar project can take 4 to 6 years, depending on land use, objections, and environmental reviews. In the Netherlands, permitting is faster—but still vulnerable to nitrogen-related rulings and delays in offshore infrastructure approvals.

Grid congestion: In the U.S. Northeast and large parts of the EU, clean energy projects are stuck in interconnection queues—waiting years for access to capacity that doesn’t yet exist. In the Netherlands, TenneT has warned that grid capacity for new offshore wind—like IJmuiden Ver—won’t be available until 2029, even though the project was awarded in 2024.

Mismatch between funding and bankability: Public grants and subsidies often target “innovation” or “impact,” but they don’t make projects financeable without real revenue certainty. The Netherlands had to postpone offshore wind tenders for IJmuiden Ver Gamma and Delta in 2024 after developers flagged the subsidy-free model as commercially unworkable.

FOAK syndrome: Everyone wants to fund first-of-a-kind projects. But no one wants to take first-mover risk. The result is a long list of headlines, and a short list of delivered assets. In the Dutch Demo 1 and Demo 2 projects—meant to be the world’s first offshore green hydrogen demonstrators—deployment is still stuck circling subsidy corridors and feasibility studies.

The outcome? Overpromising, underbuilding, and a widening credibility gap.

From national targets to actual delivery—clean energy capacity drops off at every step of the system. Most projects die somewhere between ambition and execution. (Representative numbers based on WindEurope, IEA, and industry reports)

The execution funnel shows the structural leakage—how big targets shrink at every step between policy and delivery. But this isn’t inevitable. These drop-offs happen because we’re still building around assumptions, misaligned incentives, and institutional blind spots.

If we want different results, we need different habits—starting with how we scope, fund, and de-risk projects from day one.

What Needs to Happen

The problem isn’t vision. It’s execution. We don’t need more targets or task forces—we need systems that can actually deliver.

Challenge assumptions early. Most transition “visions” collapse under basic stress tests: How much does it cost? Who pays? When does it connect to the grid?

Align stakeholders around risk, not just branding. A joint press release doesn’t mean alignment. Projects fail when technical, commercial, and political timelines are misaligned—or when risk sits with whoever has the least leverage.

Make public funding smarter. More subsidies won’t fix broken designs. Target real delivery barriers—like permitting, offtake certainty, or bankability—and support projects that can break ground, not just make headline.

Bring in independent thinking. Internal teams are often too close to challenge the consensus. External clarity helps pressure-test assumptions, reframe blockers, and break deadlocks.

The Bottom Line

The gap between ambition and execution is no longer a side issue—it’s the defining challenge of the energy transition. Technology is advancing. Capital is available. Policy targets are in place. But delivery still stalls at the system level.

Closing that gap means shifting how we plan, de-risk, and govern projects—from bold ideas to bankable, buildable infrastructure. It’s not about scaling back ambition. It’s about building the structures that make it executable.

If your team is working on a project that needs clearer framing, stronger alignment, or sharper delivery logic—we can help.